Dear Friends,

Tuesday, November 6, 2012, will be the most important election in history, as far as I am concerned. This election will not only affect our country now but also future generations for years to come. We need to change the direction in which our country is headed. Without God in our country and our lives we will fail. We have been taught this principle forever. Let’s get back to what we were founded on: May God bless you, our country and our new President.

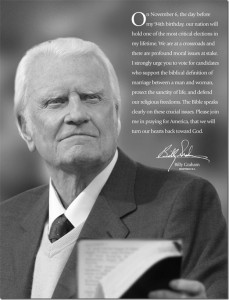

Also, I would like to share this special message from Billy Graham:

To follow South Carolina election results, please visit www.scvotes.org.

Information continues to be released regarding the cyber attack at the S.C. Department of Revenue. This newsletter is to help update you with some newly released information.

Even though I will not have any opposition in November, I still need your financial support. To have a strong voice in Columbia, I have to communicate with my constituents. And that is you! My website, newsletters, mailers and Facebook are the communication tools that I use. It takes extra time and campaign funds to maintain them.

If you would like to contribute, please mail a check to Hixon For House, P.O. 7927, North Augusta, SC 29861 or contribute online by going HERE.

I hope that you find this update helpful and informative:

Legislative Update – November 5, 2012

Frequently Asked Questions from the Governor's Office:

INDIVIDUAL TAX PAYER

Q: Who may have been affected by the SC DOR security breach?

A: Individual tax payers, their dependents, and businesses who have filed a S.C. tax return since 1998 to the present may have been affected.

Q: What type of personal information may have been exposed?

A: While the investigation is still ongoing, S.C. tax payer’s Social Security Numbers, debit card numbers, credit card numbers, and information that would be found on the front of a check like bank account and routing numbers may have been exposed.

Q: What should you do if you have filed a S.C. tax return since 1998 to present?

A: If you have filed a S.C. tax return since 1998 to present, the State is offering you the opportunity to register with ProtectMyID™ free of charge. There are two ways to register:

- Option One: Sign up online.

- Go to www.protectmyid.com/scdor and use the activation code: SCDOR123 to initiate the registration process.

- All future notices from Experian® will be sent to you by email.

- Only one email address may be associated with one registration for ProtectMyID™.

- Option Two: Call the Experian® Call Center.

- Call 1-866-578-5422 to complete the process with a live agent.

- You may choose to have all future notices from Experian® sent to you by postal mail or email.

- If a tax payer has no access to the internet, does not have a working email address, or there is another reason why he or she cannot access the internet, then he or she must call the Experian® Call Center.

Q: What are the hours of operation for the Experian® Call Center?

A: Monday-Friday: 9 a.m. – 9 p.m. EST Saturday and Sunday: 11 a.m. – 8 p.m. EST

Q: What benefits will a tax payer receive after registering with ProtectMyID™?

A: Experian® will provide the following

- Credit Report: You will get a free copy of your Experian® credit report.

- Daily Credit Monitoring: You will receive alerts regarding any suspicious activity, including new inquiries, newly opened accounts, delinquencies, or medical collections found on your Experian®, Equifax® and TransUnion® credit reports for one year.

- Identity Theft Resolution: If you have been a victim of identity theft, you will be assigned a dedicated, U.S.-based Experian® Identity Theft Resolution Agent who will walk you through the fraud resolution process from start to finish.

- Identity Theft Insurance: If you have been a victim of identity theft, you will immediately be covered by $1 million insurance policy that can help you cover certain costs, including lost wages, private investigator fees, and unauthorized electronic fund transfers for one year.

- ExtendCARE: You will get full access to personalized assistance from a highly-trained Fraud Resolution Agent even after the initial one year ProtectMyID™ membership expires.

Q: Is there a deadline to register with ProtectMyID™?

A: January 31, 2013 is the deadline to register for one year of identity theft protect with ProtectMyID™.

Q: How much does it cost to register with ProtectMyID™?

A: No fee is charged to you to register with ProtectMyID™ for the first year.

Q: How will someone be contacted who has filed a tax return since 1998 to present in S.C. and no longer lives in the state?

A: Notices will be sent to them by standard U.S. mail.

CHILDREN: MINORS/DEPENDENTS/ Family Secure™ COVERAGE

Even though your minor dependent may not have a credit history, you may enroll them for identity theft protection. All individuals under the age of 18 must be enrolled by one parent or guardian. A parent or guardian will be notified several weeks after registration when Family Secure™ enrollment has opened by postal mail or email.

- Minors are individuals under the age of 18.

- Dependents are individuals who are claimed as dependents for tax filing purposes.

Q: Have minors’ Social Security Numbers been exposed?

A: Social Security Numbers of minors and/or dependents may have been exposed

Q: How do I enroll a minor for Family Secure™ coverage?

A:

- Step One: A minor’s parent or guardian must first enroll with ProtectMyID™. Only one parent or guardian may enroll the minor.

- Step Two: The parent or guardian, who enrolled in ProtectMyID™, will receive a letter or email explaining how to enroll minor dependents in the Family Secure™ plan.

- Step Three: The parent or guardian, who enrolled in ProtectMyID™, will then enroll minor depends in the Family Secure™ plan.

Q: After being enrolled as a minor in the Family Secure™ plan, what should I do when I turn 18 years old or begin to file tax returns?

A: Call Experian® for assistance at 1-866-578-5422.

Q: What are the benefits of Family Secure™ coverage?

A: The primary benefit that Family Secure™ offers is monitoring the identity (primarily the Social Security Number) of the minor for one year, even if the minor has no credit report. Once registered, in the event a child does not have a credit file, if any credit, loan or similar account is opened with that information Experian® will alert the parent or guardian. Details of the alerts on minors are not released unless or until the parent or guardian authenticates themselves with Experian® as the parent or guardian of the minor.

Family Secure™ coverage is for one adult and any number of minors. (Five minors can be enrolled via the website. For more than five, the customer must call Experian®). The adult coverage includes a $2 million product guarantee covering the whole family, Score Tracker and Fraud Resolution.

Minors receive monthly monitoring for existence of a minor’s credit report, and if a credit report is found, then Experian® monitors for any changes to that report.

Q: What if I file joint tax returns or have joint banking and credit accounts with my spouse?

A: Every individual with a Social Security Number should register with ProtectMyID™ separately, because credit histories are tied to individual’s Social Security Numbers.

Q: Will my deceased family members be at risk?

A: It is not necessary to sign the deceased up for ProtectMyID™. However, you should notify all three credit bureaus (Experian®, Equifax® and TransUnion®).

ADULT DEPENDENT/DISABLED

Q: How do I protect an adult who is a dependent and/or is disabled?

A: The individual charged with the legal authority to assist a dependent adult filing taxes can enroll the dependent adult with ProtectMyID™ as long as that individual provides proper documentation to Experian®.

MILITARY PERSONNEL

Q: What if I serve in the military and filed taxes in South Carolina since 1998 to the present?

A: The State of S.C. will work with the U.S. Department of Defense to identify and notify all military personnel who have filed S.C. taxes since 1998 to the present.

BUSINESSES

Q: What should I do if I am a business owner?

A: S.C. business owners are being offered two free products. Businesses have the opportunity to enroll with both Dun & Bradstreet and Experian® Business Credit AdvantageSM.

Q: What type of business information may have been exposed?

A: While the investigation is still ongoing, Federal EIN numbers, SC Department of Revenue tax ID numbers, credit and debit card information, and bank account information may have been exposed.

Dun & Bradstreet:

If your business has filed a S.C. tax return since 1998, you should contact Dun & Bradstreet Credibility Corp. who will give S.C. businesses a CreditAlert product that will help them stay alerted to changes in their D&B® scores or ratings and other indicators of fraudulent activity that could be taking place on their business. The deadline to register with Dun & Bradstreet is January 31, 2013. There are two ways to register:

Option One: Sign up online. Go to www.DandB.com/SC to initiate the registration process.

Option Two: Call Dun & Bradstreet Credibility Corp Call Center. Call 1-800-279-9881 to complete the process with a live agent. Hours of operation: Monday-Friday 8 a.m. to 8 p.m. EST.

Experian® Business Credit AdvantageSM:

If your business filed a S.C. tax return since 1998, Experian® is offering a comprehensive business credit monitoring service called Business Credit AdvantageSM – a service that allows unlimited access to the company’s complete business credit report and score, plus instant email notifications of changes to the business credit profile. These email alerts include reported changes to the business address, credit inquiries, newly opened credit lines, and score changes. South Carolina businesses can begin to view and protect their business credit information with Experian® by signing up for Experian® Business Credit AdvantageSM at www.smartbusinessreports.com/SouthCarolina.

How to enroll:

- Go to www.SmartBusinessReports.com/SouthCarolina

- Register to get an Experian® business credit monitoring access code

- Follow instructions on the email to redeem the access code at the web address provided

You can view Live Broadcasts of the South Carolina House of Representatives daily legislative sessions by clicking Here.

Go to the new House Roll Call Votes Page to see how all the representatives have voted on all the important bills.

Thank you for the privilege of serving you in Columbia. If I can ever be of assistance to you, or if you have ideas on issues you want me to share with the rest of the General Assembly, please don't hesitate to contact me at Home – 803-278-0892 or at work 803-279-8855.

Sincerely,

Bill Hixon